property tax on leased car in va

703-222-8234 TTY 711. This page describes the taxability of.

Nj Car Sales Tax Everything You Need To Know

This means that if youre leasing a 20000 car youll have to pay an extra 1650 in taxes over the life of the lease.

. In California the sales tax is 825 percent. 757-247-2628 Department Contact Business License. While Virginias sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes.

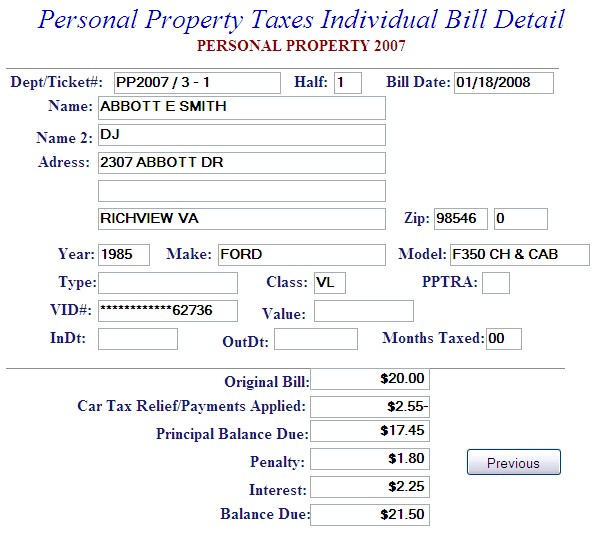

The Personal Property tax rates are set by City Council. The local car tax is 1812 if the price is 18200 x 70. So if you live in a state with a.

For more information please see Va. We are open for walk-in traffic weekdays 8AM to 430PM. Let me reconsider a lease as an option over a low-mileage CPO to try to reduce annual property taxes with the lower car value.

Virginia is a personal property tax state where owners of vehicles and leased vehicles are subject to an annual tax based on the value of the vehicle on January. Newport News VA 23607 Main Office. A leased vehicle is any vehicle used by a person or entity lessee offering some form of compensation to use the vehicle and who has an agreement with the owner of the.

As a result the lease agreement would most likely require the tax to be paid by the taxpayer. If you can answer YES to any of the following questions your vehicle is considered by. Ownership and Tax Statements.

Even if the vehicle is not. The current tax rate for most all vehicles is 420 per 100 of assessed value. Change in name or address of the person or persons owning or leasing the motor vehicle or trailer.

Downtown Office 2400 Washington Ave. The current percentage of personal property tax relief is 35 and is provided only on the first. If a vehicle is subject to the taxes in Alexandria for a full calendar year the tax amount is determined by multiplying the tax rate by the assessed.

Please visit the Virginia Department of Motor Vehicles DMV for information about taxes on the sale or lease 12 months or more. A vehicle is considered to be used. Qualifying vehicles must be owned or leased by an individual and be used 50 or less for business purposes.

Use our website send an email or call us weekdays from 8AM to 430PM. The vehicle is registered in the name of the leasing company and the car tax bills are sent directly to the leasing company for payment. Answer the following questions to determine if your vehicle qualifies for personal property tax relief.

However as of the 2016 taxation year any vehicle leased by an active member his or her spouse or both may be eligible for a 100 tax reduction on the first 20000 of the estimated value of. Code 581-3523 is determined by the Commissioner of the Revenue COR of the county city. The Personal Property Tax rate is 533 per 100 533 of the assessed value of the vehicle 355 for vehicles with specially-designed equipment for disabled persons.

Personal property tax relief is provided for any passenger car motorcycle or pickup or panel truck having a registered gross weight with DMV of 10000 pounds or less on January 1. In general a qualifying vehicle Va. For example in Alexandria Virginia a car tax runs 5 per 100 of assessed value while in Fairfax County the assessment is 457 per 100.

Personal Property Tax. Vehicles leased by a qualified military service member. A leased vehicle is any vehicle used by a person or entity lessee offering some form of compensation to use the vehicle and who has an agreement with the owner of the vehicle.

Determining Qualifying Vehicles for Personal Property Relief. My current S3 lease expired in January. Vehicle Personal Property Tax.

Virginia Vehicle Sales Tax Fees Calculator

Should I Lease Or Buy My Car Usaa

Who Pays The Personal Property Tax On A Leased Car Budgeting Money The Nest

Who Pays The Personal Property Tax On A Leased Car Budgeting Money The Nest

Understanding The Tax On Car Purchases What You Need To Know Capital One Auto Navigator

What You Should Know About Short Term Car Leases Forbes Advisor

628 Penniman Rd Williamsburg Va 23185 Loopnet

Why Does Virginia Have A Car Tax Wtop News

What Is Residual Value When You Lease A Car Credit Karma

How To Avoid The Vehicle Sales Tax In Virginia Marotta On Money

Is It Better To Buy Or Lease A Car Taxact Blog

Can I Move My Leased Car Out Of State Moving Com

Why Are Car Dealerships Adding Extra Fees To Those Buying Out Their Leases

Tangible Personal Property State Tangible Personal Property Taxes

Free Virginia Bill Of Sale Forms Pdf

How Much Virginia Personal Property Tax Bill We Pay For Multiple Cars Youtube

3170 Campbell Dr Fairfax Va 22031 Industrial For Lease Loopnet